Introduction to Dubai Real Estate Investment Opportunities for International Buyers

This is the ultimate guide on buying Dubai real estate as an international investor. This chapter will introduce you to the many immediate action steps available to you in this extremely vibrant cosmopolitan city, and the benefits that can come from taking them. Dubai is a worldwide business, vacation, and luxury-living capital, and as a result, has a lot of investment opportunities to cater for differing needs and budgets.

In this video, we will be looking at the major reasons that make Dubai one of the top destinations to invest in real estate due to its strategic location, high-quality infrastructure, tax benefits, and a wide range of options when it comes to the property offers. This will also involve addressing myths & concerns related to investing in Dubai and will give an in-depth clarity of the pros & cons of investing.

As you set off with your associated difficulties as an international real estate investor in Dubai, we hope to provide you with the basics and leave the rest up to you. Keep an eye out for future chapters as we will explore Dubai real estate in more depth, taking you through the investment cycle, how to finance property in Dubai and the key things to know to ensure your investment is optimised.

Analyzing the Situation: Understanding the Allure of Dubai Real Estate

The real estate market of Dubai has become of interest to foreign investors wishing to make profitable investments. The factors that add to the appeal of Dubai Real estate Market, highlights of its distinct benefits, what makes it an exceptional real estate destination for real estate investment.

The stability of the economy is at the highest levels, the political situation is at peace, Dubai is strategically located and it comes the resulting environment of security and other components that are attractors for investment in real estate in Dubai. It also reviews policies and regulations of the government to boost foreign investment like promoting freehold ownership rights, tax-free returns and attractive infrastructure.

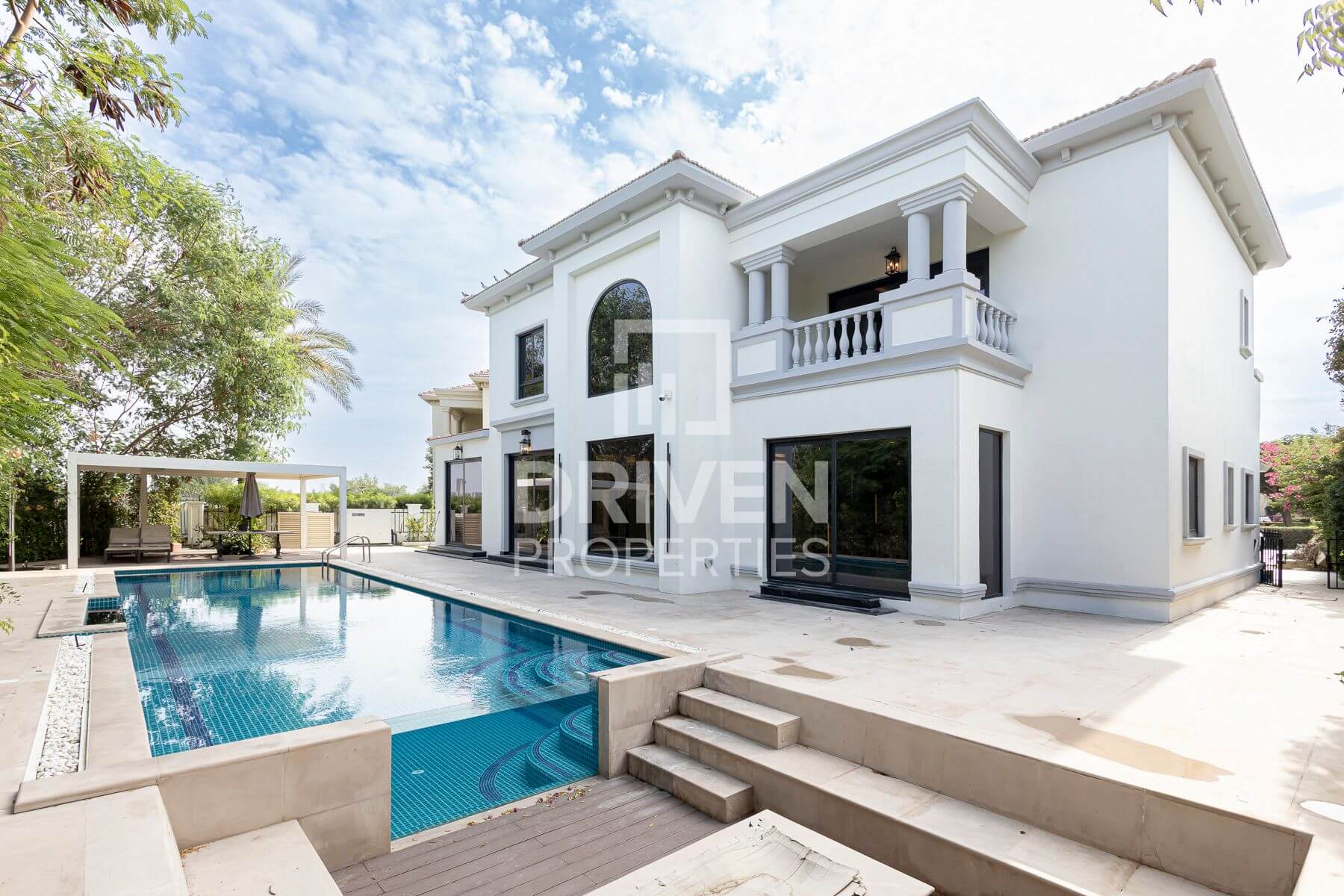

It also looks at the wide variety of real estate options for a full spectrum of budgets and purposes in Dubai. The chapter details the various asset classes from luxury waterfront properties to affordable apartments and from commercial spaces to residential developments with their expected returns.

It is becoming the go-to sector of the Dubai real estate market, with the agent discussing the potential of Dubai’s lucrative tourism industry. Known globally for its iconic skyscrapers and a booming enterprise enterprise district, Dubai draws tens of millions of vacationers yearly and underpins a constant demand for leases and part-time trip houses.

Overcoming Obstacles: Addressing Concerns and Misconceptions about Investing in Dubai

For those who are looking to Dubai, investing in international real estate markets can be fraught with fear and misunderstanding. In this chapter, we shall try to address some common fears and myths prevailing among international buyers planning for investments in Dubai Real Estate Market.

1. Poor Knowledge of the Local Real Estate Market: Foreign investors may start to panic over the little know how they might have about Dubai’s real estate market. However, as featured in real estate agencies and international property platforms, reputable real estate agencies will offer expert guidance, local market insights and personal support during their investment from its beginning to its end.

2. Key B about the Legal framework: The second Key concern is about the legal framework because Dubai has one of the most solid legal frameworks that guarantee the rights of the foreign investors. There are clear rules for real estate ownership and transactions,s guaranteeing the transparency process and security for international buyers.

3. Foreign Exchange Costs: Foreign exchange rates can change the value of your investments. Nonetheless, the Dubai economy remains sturdy and the UAE dirham is pegged to the US dollar, so it is not as volatile an investment environment as elsewhere in the world.

4. Not having Rental Income: The existence of rental income from their Dubai properties makes some investors uneasy. Despite this, Dubai is becoming increasingly popular due to its booming population, a lucrative tourism industry and a high demand for quality rental properties – all of which make it an appealing market for rental investments.

5. Expensive Property Rates: Dubai is recognized for its high-end property rates in the real estate indices. Yet, still, opportunities exist in emerging areas for the elusive affordable price of a property, as well as off-plan properties, providing great opportunity for investment with promise of capital growth.

If potential investors take into consideration the above-mentioned concerns and misconceptions, they will be in a better position to make a conscious decision and venture into the investments opportunities available for instance in Ready to Move Apartment in Dubai.

Action Plan: Step-by-Step Guide to Successful Dubai Real Estate Investment

Being an intentional investor, when it comes to invest in the Dubai real estate, requires some thorough planning and execution. This is a complete step by step guide to guide you to make you make sure your investment journey goes smooth.

Research and Due Diligence:

Find Out the Dubai Real Estate Market Property Prices rental yield and market trend. A great real estate agent or consultant, whom you will be getting on board should offer expert knowledges and advisory on the area.

How to Identify Investment Objectives:

If at all possible, know exactly what you are looking to get in return for your investment – higher income, appreciation, or some combination of the two. It will guide you towards choosing properties that meet your goals.

Choose the Right Property:

Location, property type, amenities, and potential rental income are some of the factors that have to taken into account when you are choosing a property. Assess properties in excellent-preferred-sweltering-housing-markets, in person, or virtually, to determine, condition, and suitable for such a purpose.

Obtain Funding (if needed)

Investigate different methods of financing available to overseas buyers such as mortgages and loans for foreign investors on a non-resident basis. At the end of the day, all you need to do is compare interest rates, terms and conditions to see what appeals most to you.

Legal and Regulatory Compliance:

Learn about the legal structure for real estate foreign ownership in Dubai. Make it a point to adhere to all regulations and met all requirements such obtaining appropriate permissions and clearances.

Negotiation and Purchase:

If you are buying a property, agree on the terms with the seller or developer. Have a sales and purchase agreement reviewed by a lawyer to properly safeguard your rights and interests.

Property Registration:

The land becomes registered in your name or your LLC property company in the Dubai Land Department. How To Pay for Registration and Get Your Title Deed

Property Management and Maintenance

If you wish to rent the property out, you will want to hire a property manager who can help manage tenant relations, rent collection and maintenance for the property.

Investment Monitoring and Review

Keep an eye on the progress of your investment – how much rent you collect, the appreciation of your property value, and your current market. Adapt your investment strategy as needed.

Achieving Results: Maximizing Returns and Benefits from Your Dubai Real Estate Investment

In this chapter,we are going to analyze the different methods and approaches to help you ensure that you will get your moneys worth the fullest from a purchase in Dubai real estate. Some main points that we will cover here:-

1. Rental Income:

Market knowledge in rental in Dubai and most wanted areas, with the best return on investment on rental business.

Determining Competitive Rental Prices and Marketing Your Property to Rent it Fast to Great Tenants.

Tenants handled, maintenance issues solved, rents collected on time.

2. Capital Appreciation:

Investing in rapidly growing markets or those with potential growth due to development or infrastructure improvements.

Off Plan Properties, which are part of new Developments With attractive price points and potential for future appreciation.

Watching for market trends, economic indicators, and other geopolitical events that could affect the value of the property.

3. Property Management:

Having a property management company to handle the everyday stockpile of your property.

This maintenance helps you keeps your asset in its desired condition.

Resolving tenant complaints quickly and effectively, to maintain great tenant-relationships.

4. Exit Strategies:

How to exit your investment in a successful manner, whether that means cashing out from a sale or holding long term.

About richy 2030 Understanding the tax impact and laws associated with selling dubai property

Contracting with real estate agents or brokers to handle the sales, negotiation, and securing of the highest asking price

Implementing these strategies and also hiring a professional help will ensure your Dubai real-estate investment provides you a rewarding, successful experience yielding highest returns and benefits for you.

Navigating the Dubai Real Estate Market as an International Buyer

Investing in Dubai’s real estate market as a foreign investor has both its advantages and disadvantages. It consists of methodologies and experts’ opinion with proven research to make sure give a boost to help you with the process:

Location and Market Intelligence: Understand: Dubai market trends, regulations, and investment hotspots. Including property prices, returns, and market predictions

Hire a Local Real Estate Agent – Work with a local real estate agent who specializes in international investments. They can offer helpful advice, negotiate for you, and make sure the process goes smoothly.

1-Legal and Regulatory: An Issue of Concern is a Confusing & Distorted Legal Framework for Foreign Ownership of Real Estate in Dubai. Check with your attorney about staying compliant with all regulations and requirements.

Property choice Evaluation of properties based upon place, Potential leasing earnings, appreciation Potential, and Characteristics. If you are going for higher returns then consider off-plan properties, but there is also more risk involved, just like any other type of investment.

Financing: Mortgage & Financing options for overseas property buyers Explore the opportunities at local banks, international lenders and specialised financial institutions.

Property Management: To rent the property, you cud hire professional property manager who cud take care of everything right from maintenance to rent collection to tenant relation.

Exit Plan: Decide in advance how and when you will exit the trade. Having a easy to understand exit plan is essential, especially if you want to sell the property or if you want to hold on to it for a long period of time.

You can increase your success chances and can gain maximum benefits of investing in Dubai villas for sale or Ready Villa Dubai by following these strategies and tips by experts.

Legal Considerations: Understanding the Regulatory Framework for Foreign Real Estate Ownership in Dubai

we dig deep into the complex legal waters of buying property in foreign shares in Dubai. A thorough overview of the regulatory framework that specifies the rights, responsibilities, and constraints which global investors must obey. We cover the following main focus points in our analysis:

1. I. Freehold vs. Leasehold Ownership

Home equity or Leasehold (we touch on the points for overseas buyers in the piece to differentiate). In this blog we share the few parts in Dubai which are permitted for freehold ownership and clarify benefits and limitations of both types of ownership.

2. Eligibility and Restrictions:

In this article, we take a look at the conditions and restrictions that foreign investors must meet when looking to invest in residential properties in Dubai. Our readers will know exactly which nationalities and companies can own and which properties they can or cannot own.

3. Ownership Structures:

Here we discuss the types of ownership available to international investors, covering how you can own property and what exactly ownership means. We describe the pros and cons of each model, to assist investors in deciding the most suitable model respectively to them.

4. Legal Documents And Process:

In this article, we explain the legal papers and procedures in detail on how to buy a property in Dubai, being a foreigner. It provides information on title deeds, registration and the documentation you require. The content is a general ancient situation that applies to specific people and places, and you should see a qualified attorney for legal advice tailored to your situation.

5. Taxation and Fees:

Explanation on Tax due to Investing in real estate in Dubai In addition to these, we talk about the types of taxes and fees that foreign buyers have to pay, such as property registration fees, transfer taxes, as well as annual property taxes. We break down all tax responsibilities and expenses related to acquiring and disposing of property in Dubai.

Chapter VII: Overview of Dubai Real Estate Ownership Law and Regulation This final chapter provides a detailed insight about the legal framework and regulatory concerns related to foreign real estate ownership in Dubai, in order to give potential foreign investors a sense of possibilities and confidence to negotiate successfully in the light of the legal realities governing real estate transactions.

Financing Options: Exploring Mortgage and Financing Solutions for International Buyers

If you are an international buyer in Dubai, now knowing what mortgage and financing options are available can help you navigate the financial landscape of the emirates real estate market. This chapter goes further into the different shell refunding alternatives that are intended to serve the global investors who are eager to dump their money into the real estate business of Dubai.

In this chapter the eligibility and application process for mortgage in Dubai are explained. It gives you the lowdown on the paperwork, credit, and income requirements. It also covers the various mortgage types that one may opt for ranging from conventional, to islamic financing, and even the different payment options.

The chapter also explores new regulations in the space, specifically on Fannie Mae, arguably the most popular and trusted source of mortgage financing, which will benefit foreign investors in making more favorable purchases and ownership decisions. They usually come with competitive interest rates, friendly terms, and easy documentation requirements. Each product also comes with its respective pros and cons which are highlighted in the chapter to help the reader make an informed decision taking into account his financial situation and investment objectives.

In addition, the chapter reviews other funding options such as equity partnerships, joint ventures, and crowd-funding experiences. Thankfully, these options provide investors with a way to mitigate some of the risk of high capital requirements in traditional real estate investments. In this chapter, alternatives to financing are discussed and the pros and cons of each method, so readers can determine which strategy is the most appropriate for their investment goals.

Also looked at are the legal and regulatory structures as they relate to mortgage and financing options for foreign buyers which finalize the information presented and help cover all angles. Covers key laws, regulations and taxation issues related to implications for property ownership and financing in Dubai. This allows readers to be in a position to make informed decisions and protect their investments, within the boundaries of local law.

Market Trends and Forecasts: Analyzing Current Conditions and Future Prospects for Dubai Real Estate

Understanding the market trends and forecasts for Dubai’s real estate sector is essential for informed investment decisions. This chapter provides an in-depth analysis of the current conditions and future prospects of Dubai’s real estate market, helping international buyers make well-informed choices.

Current Market Conditions:

- Steady Growth: Dubai’s real estate market has shown consistent growth in recent years, with rising property prices and increasing demand from international investors.

- Diversified Portfolio: The market offers a diverse range of properties, including luxury apartments, villas, commercial spaces, and off-plan developments, catering to various investment preferences.

- Attractive Returns: Dubai’s real estate market offers attractive returns on investment (ROI), with potential rental yields and capital appreciation.

Future Prospects:

- Expo 2020 Impact: The upcoming Expo 2020 is expected to have a significant impact on Dubai’s real estate market, driving demand for properties and potentially leading to price increases.

- Economic Growth: Dubai’s strong economic growth and favorable business environment are expected to continue attracting international investors and spur real estate demand.

- Infrastructure Developments: Ongoing infrastructure projects, such as the expansion of the Dubai Metro and the development of new transportation links, are expected to enhance connectivity and boost property values.

Investment Opportunities:

- Off-Plan Properties: Investing in off-plan properties can offer significant returns, especially if purchased early in the development stage.

- Luxury Developments: Luxury properties in Dubai market offers exclusive properties with high ROI potential, catering to high-end investors.

- Rental Properties: Investing in rental properties can provide a steady stream of income and long-term capital appreciation.

Conclusion:

The Dubai real estate market presents a wealth of opportunities for international investors, with steady growth, attractive returns, and a diverse range of properties. By understanding market trends and forecasts, investors can make informed decisions and maximize their chances of success in Dubai’s thriving real estate sector.